Stunning Info About How To Buy Out Your Partner

The spouse who wants to keep the house needs to be realistic.

How to buy out your partner. Your income and expenditure would need to be assessed and your affordability checked. You and your partners will likely each. In the best case, it involves partners amicably deciding to end their partnership.

If there is a possibility that you and your partner will reunite, do not start the process of a divorce mortgage buyout. With those kinds of statistics, small business. Before you can buy or sell anything, you need to know its value.

First, the property has to be valued, and any mortgages or loans associated with the property assessed. Before you begin the process of buying out a partner in a small business, consider what you hope to gain. The buying spouse takes out a big enough loan to pay off the previous loan and pay the selling spouse what's owed for the buyout.

Consider cancelling your redraw facility or at least ask your lender that any. Businesses are operated as partnerships and around 70% of those partnerships end in a buyout or liquidation. Close joint bank account and open up a separate one in your name.

Tips on separating from your partner. Your partners will need to sign a quit claim deed that quits their ownership interest in the home. Complete the quit claim deed.

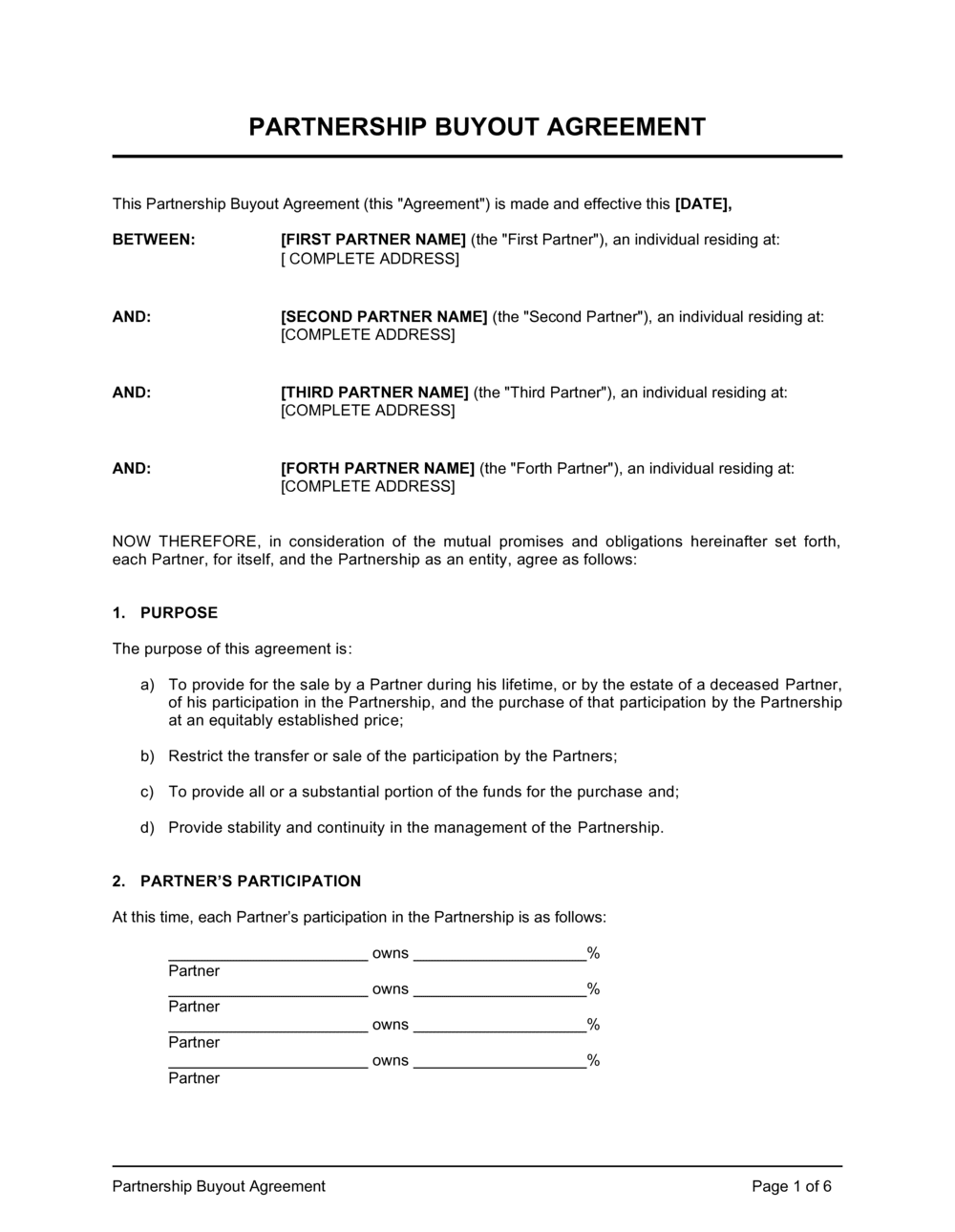

Buying out a business partner can be done in several ways. Determining the best way to finance the partnership buyout. List the partners giving up ownership as grantors.